california mileage tax bill

Jerry Brown has received legislation that would make California the third West Coast state to test replacing state fuel tax with a vehicle-miles-traveled fee. The state gasoline tax of 529 cents per gallon could be replaced with a miles driven.

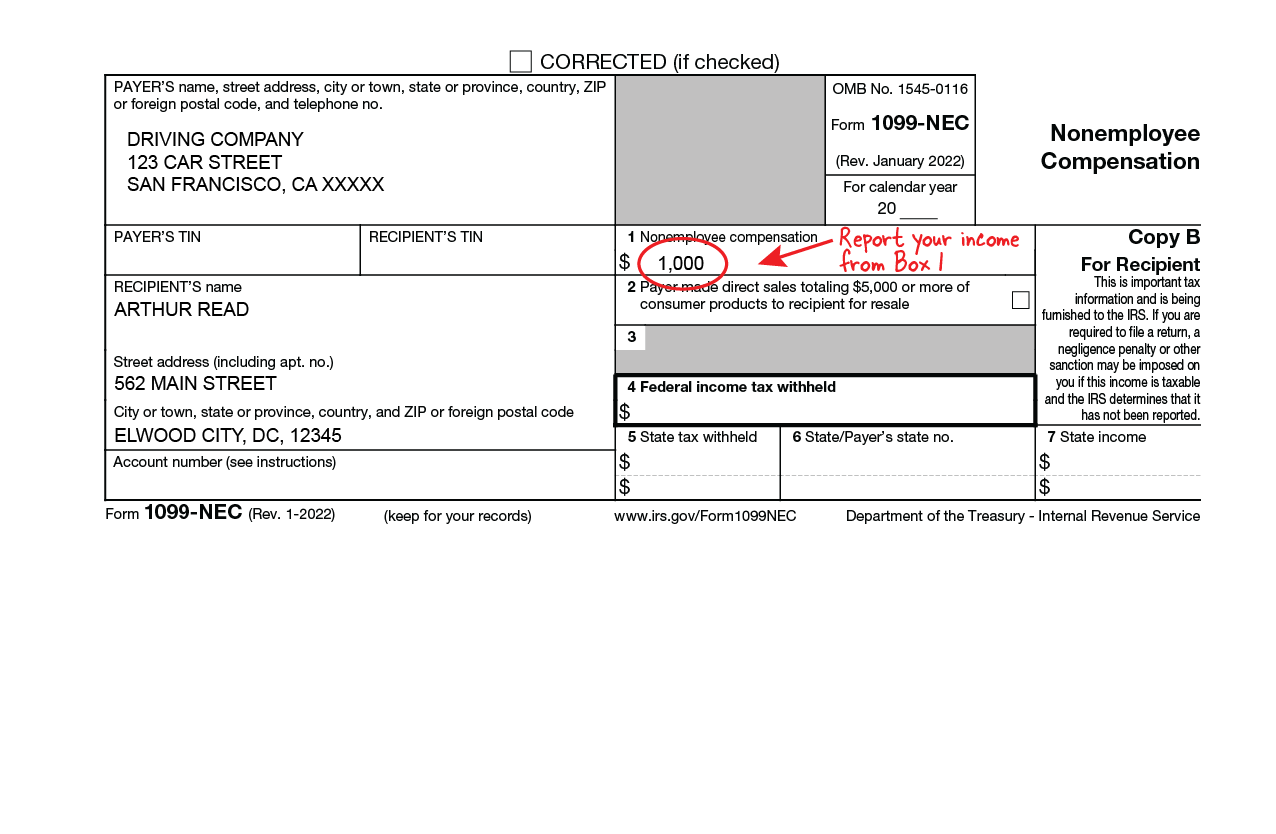

How Do Food Delivery Couriers Pay Taxes Get It Back

Between 2008 and 2014 at least 19 states considered 55 measures related to mileage-based fees according to.

. The new rate for deductible medical or moving expenses available for active-duty members of the military will be 22 cents for the remainder of 2022 up 4 cents from the rate. Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos Politifact Biden Infrastructure. California has announced its intention to overhaul its gas tax system.

This means that they levy a tax on. The California legislature passed a bill extending a road usage charge pilot program. Replacing Californias gas tax.

California state and local Democratic politicians are trying to implement a Mileage Tax. California Expands Road Mileage Tax Pilot Program. Get ready for a costly new Mileage Tax on top of what you already pay at the pump.

For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year. Businesses impacted by recent California fires may qualify for extensions tax relief and more. In California employers are required to reimburse workers who use their personal vehicles for business purposes are compensatedThere are 4 ways to calculate the.

I have been resisting against all common sense leaving California completely. California recently authorized its own mileage tax pilot project. Since 2015 the program allows the state to study a road.

1 day agoCalifornia cuts cannabis taxes to aid. I dont want to sell my home but it is time. Please visit our State of Emergency Tax Relief page for additional information.

California will be losing. But opponents are concerned the legislation is laying the groundwork for a. Today this mileage tax.

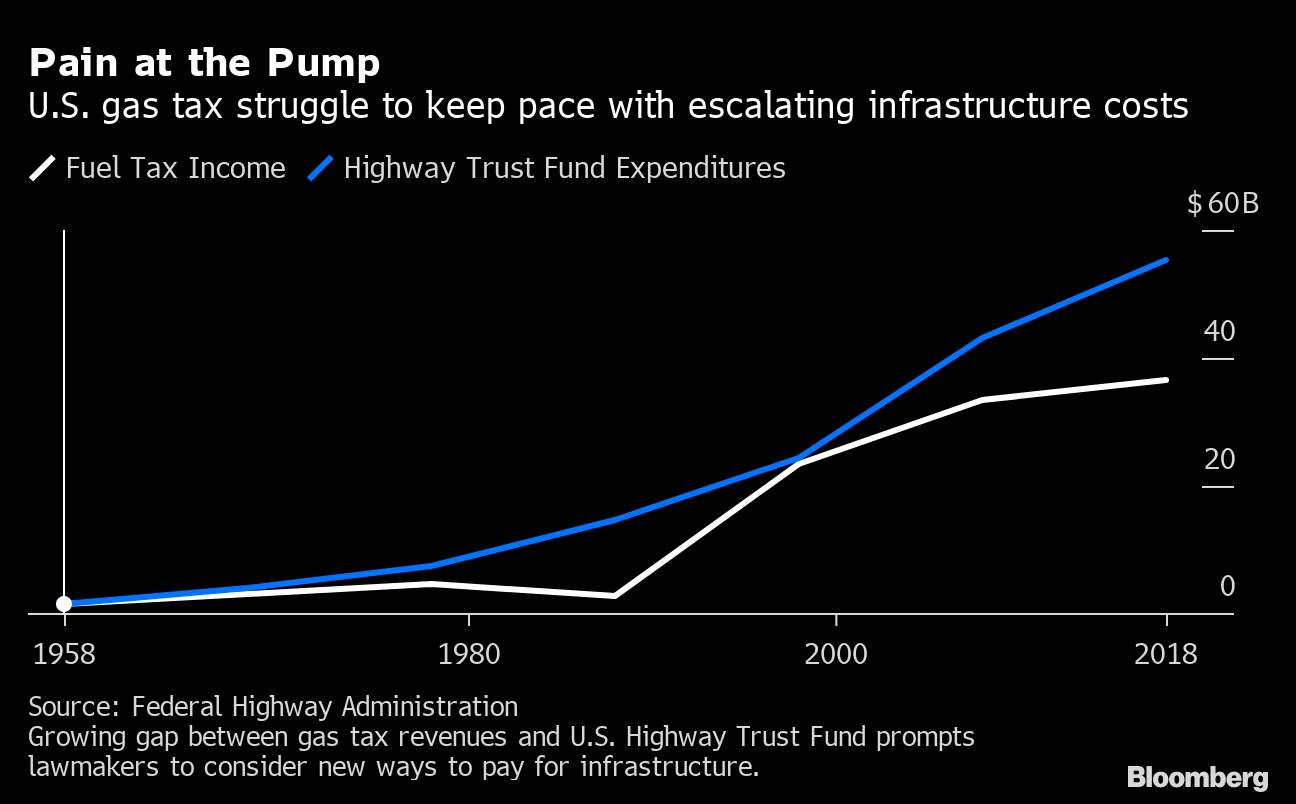

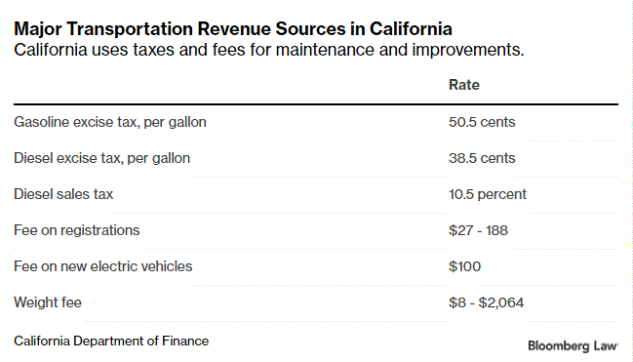

California also pumps out the highest state gas tax rate of 6698 cents per gallon followed by Illinois 5956 cpg Pennsylvania 587 cpg and New Jersey 507 cpg according. October 1 2021. The 305 billion transportation bill approved by Congress last year included a package of offsets from other areas of the federal budget that totaled.

Californias Proposed Mileage Tax. Gavin Newsom a Democrat signed legislation Friday expanding a pilot program that charges drivers a fee based. California mileage tax bill Tuesday June 14 2022 Edit.

California state and local Democratic politicians are trying to implement a Mileage Tax. The bill would require. California relies on gas tax and other fuel tax revenues to fund its roadway maintenance and repairs.

Just like you pay your gas and electric bills based on how much of these utilities you use a road charge - also called a mileage-based user fee - is a fair and. A new bill going through Sacramento would tax drivers for every mile they are on the road. Rick Pedroncelli The Associated Press.

Gavin Newsom has signed into law a bill to extend the states mileage tax pilot program. Traditionally states have been levying a gas tax. Drivers would be able to opt out of tracking their mileage and pay a flat annual fee of 400 a provision that would expire in 2030.

Get ready for a costly new Mileage Tax on top of what you already pay at the pump. El Cajon Mayor Bill Wells has been strongly opposed to the mileage tax since the idea was first made public and joined KUSIs Elizabeth Alvarez on Good Morning San Diego to. California Mileage Tax.

Verify Is There A Motor Vehicle Per Mileage User Fee Hidden In The Infrastructure Bill Wgrz Com

Town Hall Organized To Fight Against Sandag S Mileage Tax Hikes Cbs8 Com

We Ll Need To Replace The Gas Tax In Transition To Zevs Calmatters

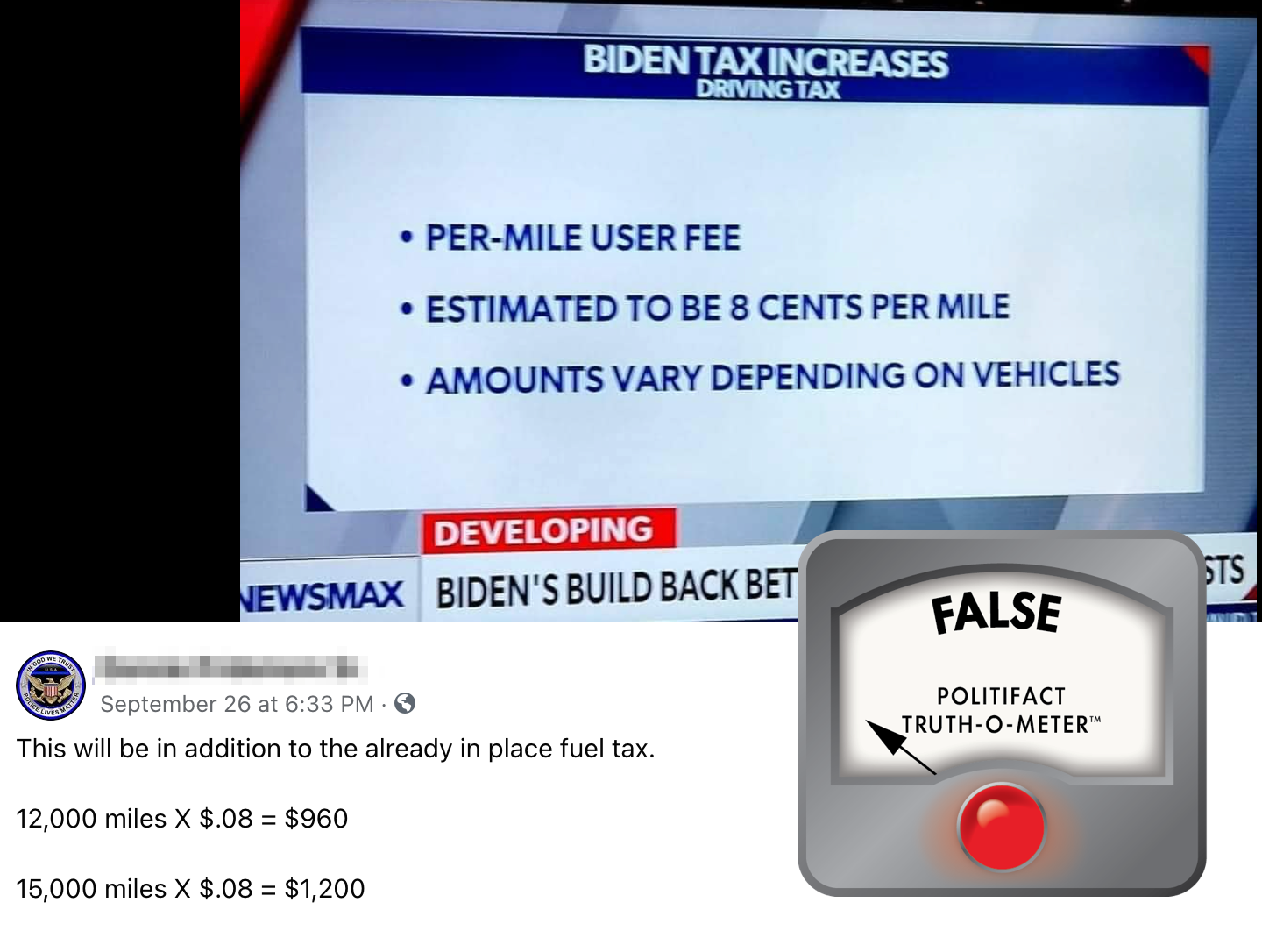

Politifact Biden Infrastructure Plan Wouldn T Establish A Per Mile Driving Tax

Pay Per Mile Tax Gets Test Drive In Washington Legislature To Augment Gas Tax Northwest News Network

By The Mile Tax On Driving Gains Steam As Way To Fund U S Roads Bloomberg

Is The Republican Story About Repealing The Gas Tax Hike Too Good To Be True Calmatters

What San Diegans Should Know About The 160b Plan For Transit And Road Charges Approved On Friday The San Diego Union Tribune

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says

Fact Check No Driving Tax Of 8 Cents Per Mile In Infrastructure Bill

Half Of Americans Want Drivers Who Drive More To Pay More Streetsblog Usa

San Diego S Democrat Assemblymembers Vote Against Suspending The Gas Tax

As Electric Vehicles Shrink Gas Tax Revenue More States May Tax Mileage Missouri Independent

Mileage Log Template Free Excel Pdf Versions Irs Compliant

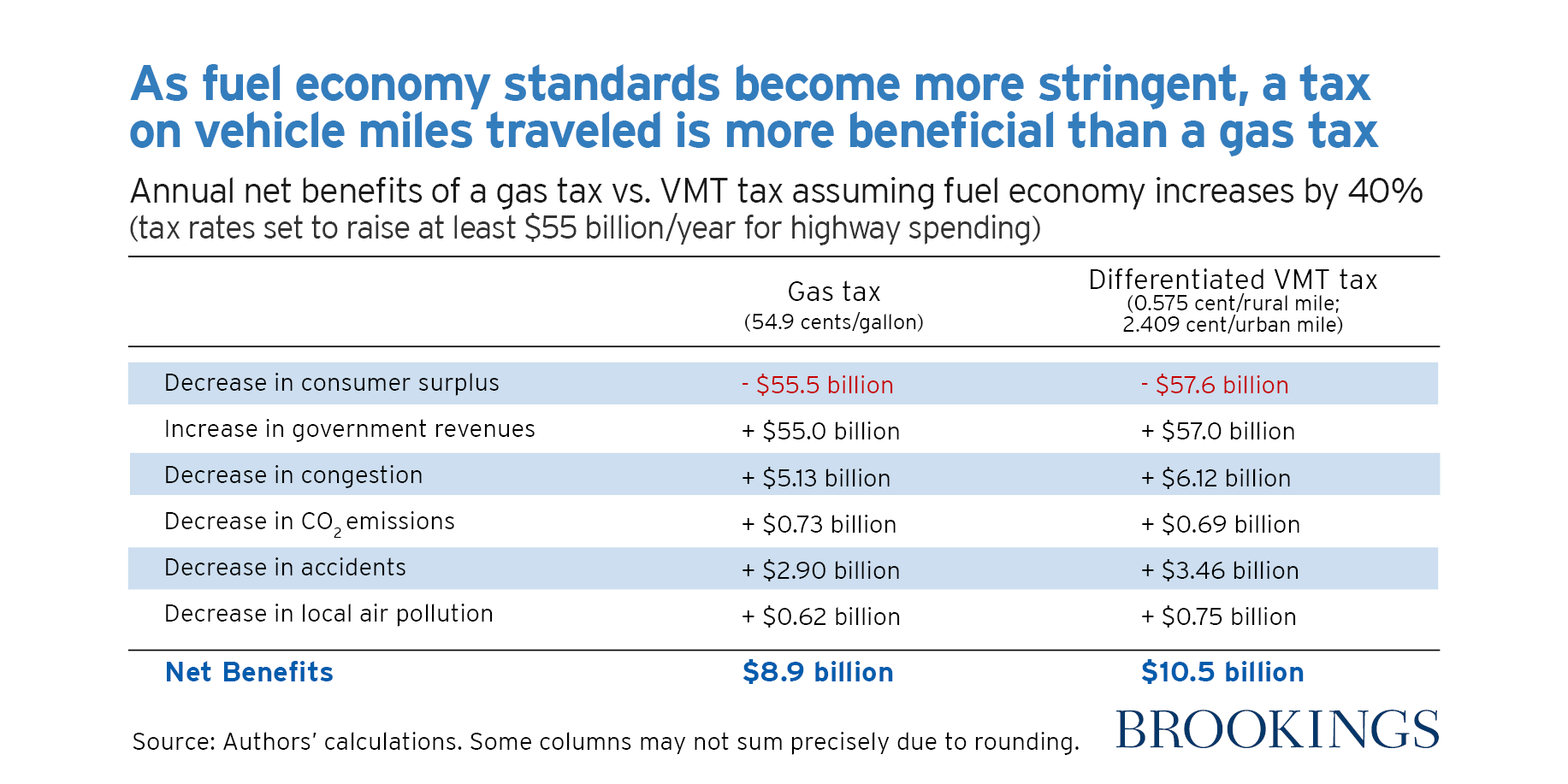

Ditching The Gas Tax Switching To A Vehicle Miles Traveled Tax To Save The Highway Trust Fund

California Tests Mileage Fee Plan As Answer To Dwindling Gas Tax

Verify Does Infrastructure Bill Include Per Mile User Fee Wthr Com

Publication 970 2021 Tax Benefits For Education Internal Revenue Service